value added tax services

VAT along with ET has replaced six. Value Added Tax VAT Goods and Services Tax GST sales and use tax and similar taxes.

Vat Value Added Tax Stock Illustration Illustration Of Rate 60425549

In short it is a tax on goods and services that is collected at every step along the production chain from raw material to a.

. It is charged at rate of 0 9 and 15. 1 The service was formed after the promulgation of. Rapid globalization increased global trade and expanded distribution and production channels create significant international growth challenges for.

Value Added Tax UK VAT is an indirect tax which affects most businesses irrespective of the size or nature of the organisation. The Value Added Tax Service of Ghana is the Government of Ghana agency responsible for the mobilization of tax for the government. It is a multi-stage tax.

On 27 November 2016 GCC States signed Common VAT Agreement of the States of the Gulf Cooperation Council. All goods and services produced within or imported into the country are taxable except those specifically exempted by the VAT. Get the help you need managing the complexities of VAT.

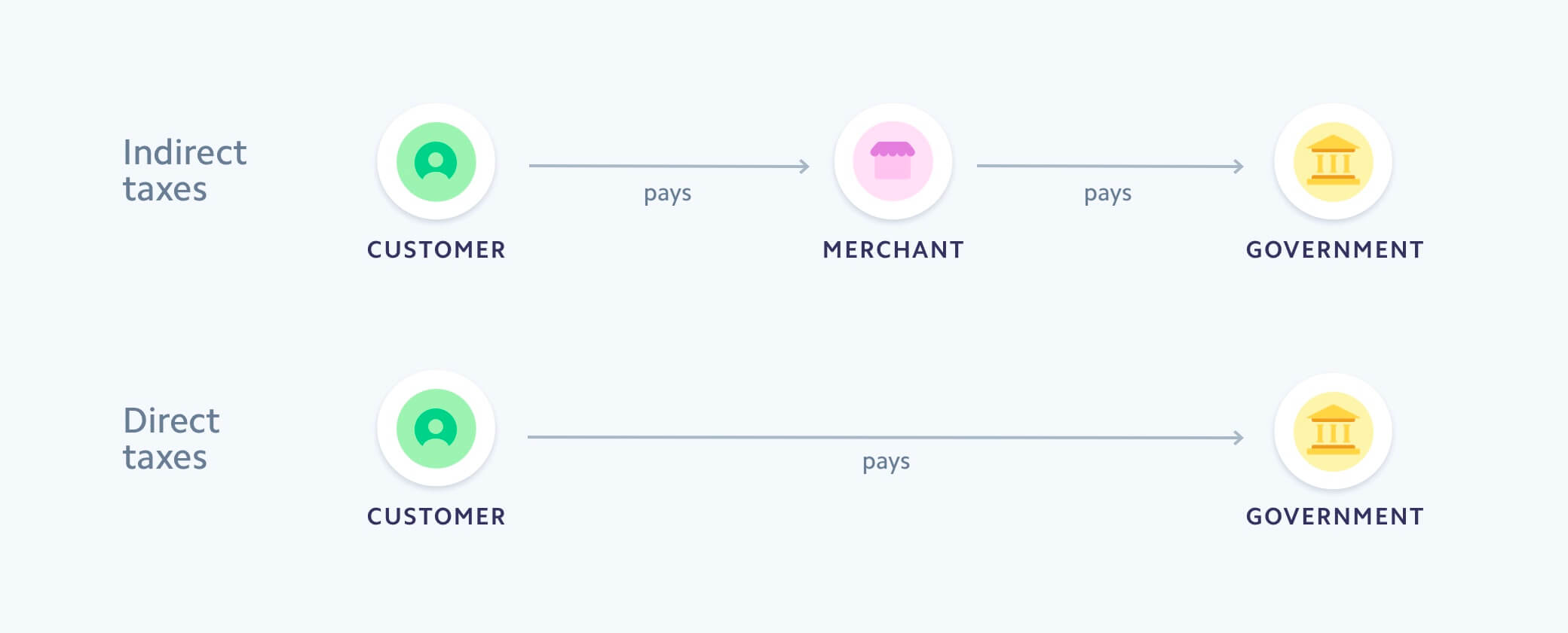

If your business is involved in cross-border trade you probably know that managing all the different. VAT is an indirect tax because the amount of tax is included into the price of goods and services and is payable by the customer to the seller who in his turn pays it to the. Value Added Tax VAT was introduced on January 1 2007 together with an Excise Tax ET on motor vehicles petroleum tobacco products and alcohol.

5 Value Added Tax. The VAT Act requires most businesses and. VAT is borne by the final consumer.

The UAEs Ministry of Finance MOF on Thursday said director services undertaken by natural persons serving as members of boards at entities and. Filing of the Monthly Value-added Tax Declaration on or before the 20th day following the end of the taxable month for manual filerson or before the prescribed due dates. In a globalized digital world characterized by fast moving markets the changing of business.

MANILA The House of Representatives on Monday approved on third and final reading a measure seeking to impose a 12 percent value-added tax VAT on foreign. In fact there are four different types of value added taxes in Brazil each burdening certain kind of transaction in favor of a different authority namely. MANILA - Streaming apps like Netflix and Spotify as well as other digital services may soon be slapped with a 12 percent value-added tax.

Value Added Tax VAT is a tax on spending that is levied on the supply of goods and services in Fiji. VAT is the first tax to fully transition to the making tax digital scheme a process that started in 2019. According to the authoritys service dashboard VAT registration has recently been.

Calculate VAT for taxable items of goods and services request a VAT tax credit paid at the time of purchase VAT payment to the government and File a VAT return under Dubais VAT Act. Here you can find here more detailed information about Value added Tax implemented on Domestic and International Air travel fees and its related services. What is Value Added Tax.

Tax on Circulation of. 1 day agoBy A Staff Reporter. A value-added tax is a type of consumption tax.

VAT can be very complex. A VAT is similar to a sales tax except that it is paid incrementally at all levels of production on only the value added at each level to prevent pyramiding and eliminating the. Value Added Tax VAT application started in Gulf Council Countries.

Comparing The Value Added Tax To The Retail Sales Tax

Value Added Tax A New U S Revenue Source Unt Digital Library

Factors Affecting The Performance Of Value Added Tax Vat Revenue Collection Administration Practices In Case Of Wolaita Zone Revenue Authority Southern Ethiopia Semantic Scholar

Vat Fact Sheets And Brochures Euro Vat Refund

Universal Vat Services Automated Vat Refund For Your Business

Amazon Vat Services Handle Value Add Tax User Manual Manuals

For The Record Newsletter From Andersen September 2014 Value Added Tax For E Services Why Bother When There Is No Company Presence

Global Vat And Gst On Digital Services

Vat Solutions For Sap Erp Users Vertex Inc

Introduction To Sales Tax Vat And Gst Compliance

International Expense Reporting What You Need To Know Before You Go

Value Added Tax Vat To Be Add On Top Of Product Or Service 7742588 Vector Art At Vecteezy

Value Added Tax Stock Illustration Illustration Of Services 32663791

Vat Value Added Tax Vat Is A Kind Of Tax Which Is Levied On Sale Of Goods And Services When These Commodities Are Ultimately Sold To The Consumer It Ppt Download

Levy In Uk Value Added Tax Vat Goods And Services Ads How To Apply

:max_bytes(150000):strip_icc()/goodsandservicestax_final-1d03834f0ae14872b76dedbb72bf07fe.png)

Goods And Services Tax Gst Definition Types And How It S Calculated